What We Do

We are a Multi-asset & Multi-strategy Quantitative Algorithmic Hedge Fund with a solid track record since 2007

Algorithmic Trading

Our algorithmic trading strategies are designed to identify and capitalize on market inefficiencies across various asset classes.

Multi-Market Diversification

We diversify across multiple markets, instruments, and timeframes to optimize performance and reduce risk exposure.

Quantitative Analysis

Our sophisticated quantitative models analyze vast datasets to predict market movements and execute trades with precision.

Performance Optimization

We continuously monitor and adjust our strategies to adapt to changing market conditions and maintain consistent performance.

Investment Strategy

Quantitative Approach

We employ advanced quantitative methods, using algorithms and computer models to analyze extensive data, defining our investment strategies.

Transaction Types and Size

Our focus is on short-term trading in derivatives, stocks, and ETFs, employing algorithmic strategies to diversify across assets and timeframes.

Investment Pace and Holding Periods

Known for a rapid investment pace, we capitalize on short-term market movements, with holding periods generally not exceeding a few weeks, distinguishing us from traditional approaches.

Geographic and Industry Focus

Maintaining a global perspective, we diversify across industries and sectors without restrictions on regions or sectors. Our strategies encompass various futures from stock indices to commodities.

Risk Management

Ensuring security is paramount to us. We achieve this through vigilant risk management, employing strategies like position stop loss and distributing asset weights through position sizing. Engaging in both long and short positions fosters diversification and wide diversification across all types of securities.

Key Values

Aligned with clients

Our profits come solely from the earnings we generate for our clients. We only make earnings from client earnings.

Evidence-based

We use a proven strategy that has been tested and refined over time. Using backtesting and statistical models to generate results.

Tested and proven

We don't expect to make experiments on people, we offer only proven results based on statistical models.

Solid in hard times

Since our strategies work in bearish conditions, we are solid in hard times. Keeping liquidity safe for coming opportunities.

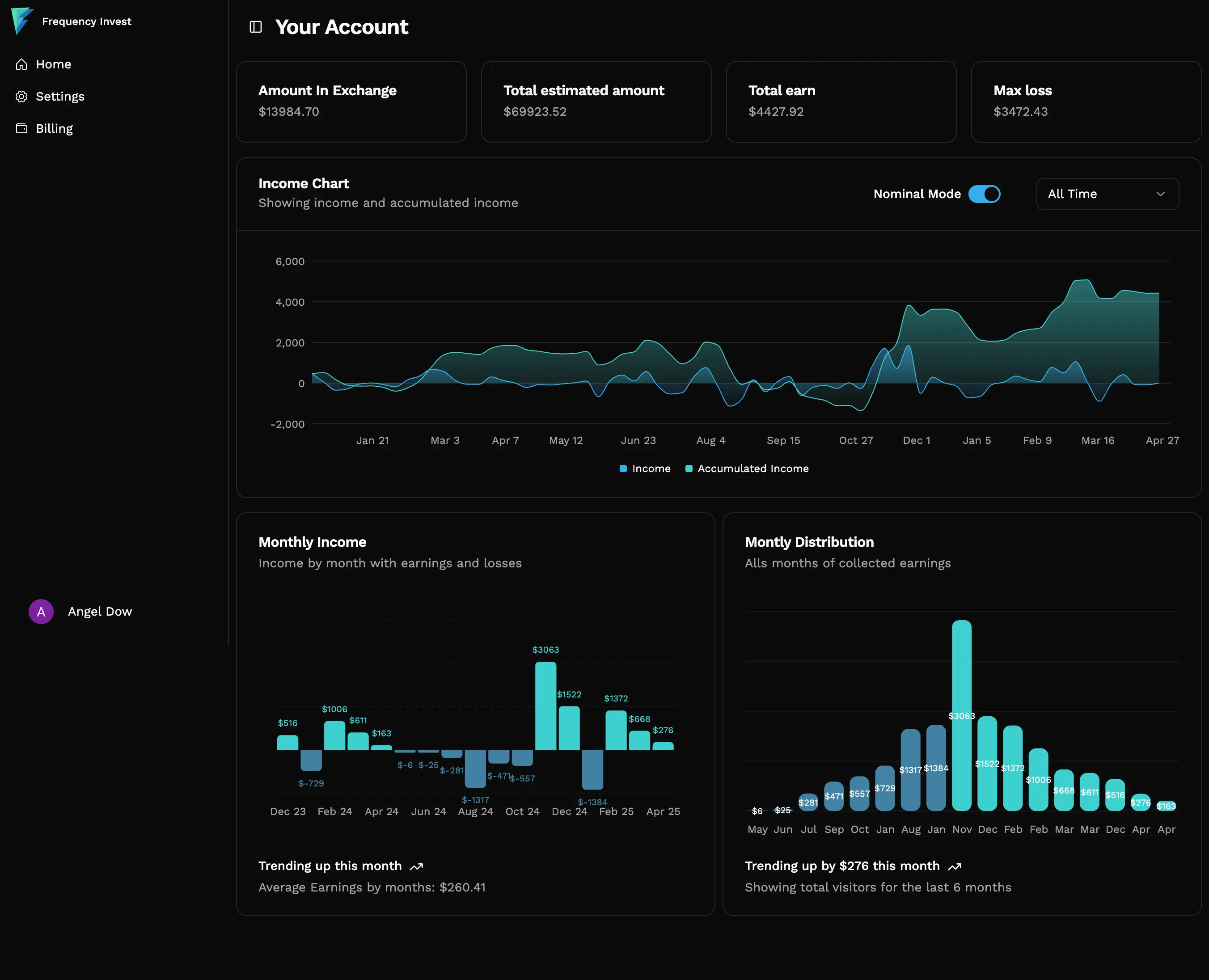

PROFIT EXPECTATIONS

As a quantitative trading firm, we provide automated strategies that aim to protect and grow capital over the long term. By using efficient margin and controlled leverage, we allow investors to unlock capital efficiency while minimizing risk.

Our strategy targets an estimated return of 8–15% annually in USDT. While past performance is not a guarantee of future results, this projection is based on historical data and our current algorithmic models.

To visualize our real-time data performance, please refer to the link below: Weekly Real-Time Profit History

Risk Management

A clear advantage of our company is the active management of risk. To ensure security, we have formulated a range of different strategies for each portfolio. As an algorithmic hedge fund, every step of this process is executed and controlled by our systems, bypassing human psychology in every step we take.

Position Stop Loss

Each and every open position has its own loss tolerance threshold and if it is reached, the position is automatically closed by our systems who take control at the moment when panic and hope can affect investments more.

Position sizing

Equivalent distribution of the relative weight of every asset we trade is a way to ensure that none of them excessively affect the client's capital.

Bi-directionality

We can trade both long and short positions, which allows us to be market agnostic, that is, staying distant and independent of what is happening in the market.

Diversification

Since we can trade every type of security, we take advantage of diversification in markets, financial instruments, directionality, strategies and time frames.

Decorrelation

Our sophisticated method and technology allows us to take the decorrelation strategy to the extreme, so price triggers never affect different positions the same time, the same way.

Our Services

We provide cutting-edge financial solutions powered by advanced technology and expert knowledge

Top-notch technology

We use cutting-edge AI developed by experts to provide you with an investment platform that stands out for its ability to deliver results even in complex market conditions.

Total transparency

We believe in transparency in everything we do. We give you access to clear and detailed information about our automated investment strategies and the performance of your portfolio

Security and trust

Our automated tools are backed by the supervision of investment and AI experts, giving you peace of mind that your money is in good hands

WHY US?

Quick and Seamless

Start your investment journey with us in just three simple steps

Open your exchange account

Create and verify your account with our trusted brokerage partner.

Fund it

Fund your account with your chosen investment amount.

Connect your account with us

We use the API to connect your account with our platform.